Identifying expiring affordable housing properties and units

Image credit: Getty Images Signature

Publication date: May 16, 2024

By Justin Campos

Introduction

Federally subsidized affordable housing programs support approximately 5 million rental homes through place-based subsidies, including public housing, project-based rental assistance (PBRA), project-based vouchers (PBVs), Low-Income Housing Tax Credits (LIHTCs), and a range of smaller federal programs that target specific populations. However, some of these housing programs have expiration dates on affordability requirements, putting tenants who rely on this affordability at risk of displacement.

This brief outlines how jurisdictions can leverage publicly available data from the National Housing Preservation Database to develop a housing preservation inventory and implement policies to help preserve affordable housing. It builds on the Housing Needs Assessment Tool (HNAT) and previous preservation inventory guidance, offering practical steps for identifying expiring affordable units. The HNAT provides a helpful overview of a city’s subsidized affordable housing stock, and this brief aims to highlight an additional helpful data source to supplement that information with detailed property-level analysis. Additionally, it explains how different federal housing subsidies operate and outlines key differences between programs with expiring affordability periods and those without.

Overview of the data used in this brief

Housing Needs Assessment Tool (HNAT)

Hosted by the Housing Solutions Lab and created in collaboration with PolicyMap, the Housing Needs Assessment Tool (HNAT) provides detailed housing data and visualizations for every city, county, and metropolitan statistical area in the country. It can be a useful tool for understanding how federal housing assistance supports affordable housing at the local level. The HNAT draws on data from U.S. Department of Housing and Urban Development (HUD) Multifamily Assistance and Section 8 Contracts, HUD’s Picture of Subsidized Households, HUD’s Low-Income Housing Tax Credit (LIHTC), and the U.S. Department of Agriculture’s (USDA) Rural Development Multifamily Housing databases to estimate the stock of federally subsidized housing units across the country and at the county and city level. (Note that some jurisdictions also have rental units subsidized by their state and local governments or via other forms of federal assistance that are not reflected in the HNAT.) The HNAT estimates the inventory of federally subsidized housing by subsidy type. It also provides average neighborhood poverty rates for these housing types, the locations of federally subsidized properties, and the number of housing units set to expire, reported in five-year increments.

The National Housing Preservation Database (NHPD) provides more granular, address-level data than is available through the HNAT. This allows cities to identify specific properties, determine the earliest and latest subsidy expiration dates for each, and analyze property conditions using Real Estate Assessment Center (REAC) inspection scores to indicate needed reinvestment. By combining the data and insights from the HNAT and NHPD, jurisdictions can apply property-level strategies to preserve affordable housing and help local policymakers and advocates better understand and respond to impending affordability losses.

National Housing Preservation Database (NHPD)

The National Housing Preservation Database (NHPD) is maintained by the Public and Affordable Housing Research Corporation (PAHRC) and the National Low Income Housing Coalition (NLIHC). The NHPD is an address-level inventory of federally assisted rental housing in the United States. It should be noted that while a housing development can consist of multiple buildings and addresses, the NHPD only lists one address as the primary address. In addition to the sources utilized for the HNAT, the NHPD draws from other publicly available data that track the use of HUD’s Section 202 direct loans, HUD insurance programs, and other databases detailed on the NHPD’s website. It is updated quarterly.

Registration is free and quick for non-profit organizations, government agencies, and universities. After registering on the NHPD website, users receive a unique login to access the database. After their first login, users can look up individual properties or filter the database by variables such as geography, subsidy status, and specific housing programs.

Affordable housing subsidies

Privately owned, publicly subsidized rental units are an important source of affordable housing in the U.S. Many of these properties are subject to time-limited affordability requirements reflected in regulatory agreements, meaning they may transition to market-rate housing once the compliance period ends. This section outlines key federally subsidized housing programs, their affordability terms, and the mechanisms by which they can be renewed.

- The Low Income Housing Tax Credit (LIHTC): This federal tax incentive program has financed more than 3.5 million housing units since 1987. In exchange for the credit, property owners agree to keep units affordable to low- and moderate-income households for at least 30 years (some states have longer affordability periods).

- The HOME Investment Partnerships Program (HOME): Affordability restrictions typically last between 5 and 20 years, depending on the project type (rental or homeownership) and the amount invested.

- Section 8 Project-Based Rental Assistance (PBRA): Each Housing Assistance Payment (HAP) contract has an initial contract term. The initial term generally lasts 20 years. After the initial term, contracts can be renewed through several options outlined in HUD’s PBRA Renewal Guidebook.

- Project-Based Vouchers (PBVs): Each Housing Assistance Payment Contract imposes affordability requirements for an initial term of at least 15 years (or up to 20 years with approval from a public housing authority, or PHA). State and local housing agencies administer PBVs. Unlike tenant-based vouchers, they are attached to a specific property. They are also distinct from PBRA, a program that HUD no longer grants, in which property owners contract directly with HUD to rent units to low-income families. Renewal decisions are made by HUD (the PHA involved). While property owners have the option to terminate their contracts, they are required to accept a tenant-based Section-8 voucher holder in the same units. These requirements, which help maintain affordability and prevent displacement, are outlined in 24 CFR § 983.206.

Affordability terms

Rent amounts are restricted to ensure affordability relative to area median incomes (AMI). HUD calculates AMI annually to determine eligibility and affordability for housing programs, adjusting it based on household size and location. Rent amounts, including utilities, are considered affordable if they do not exceed 30 percent of a household’s income.

After these affordability terms end, property owners can recapitalize and renew their affordability contract, or leave the program, which means they can increase rents. A 2022 report from Freddie Mac found that properties exiting the LIHTC program typically have higher rents than LIHTC-restricted units. However, these rents are not as high as those for conventional units, meaning the increases are relatively modest. With the oldest LIHTC properties reaching the 30-year mark in the coming years and a growing number of units reaching the end of their affordability terms, cities risk losing affordable units, and low-income residents risk displacement.

Developing a preservation inventory that identifies federally subsidized housing and tracks up-to-date subsidy expiration timelines is a critical first step towards monitoring expiring properties and proactively engaging with relevant stakeholders to prevent these losses.

Navigating the National Housing Preservation Database

Users can view and filter the NHPD database on their browsers or download the data as an Excel file. The browser version offers a condensed view of the data, while the Excel file is more detailed. In both formats, each row corresponds to a single property and indicates whether a property’s subsidy is active — this means its expiration date is after the most recent update to the NHPD database. Pertinent information, such as the type of subsidy for an individual property and its start and end dates, is also included.

The database also contains the date and score of the property’s three most recent Real Estate Assessment Center (REAC) inspections. HUD’s REAC inspects properties every one to three years. Inspectors assign each property a score from 1 to 100 based on the condition of several factors, including the site, the building’s exterior, its systems, the common areas, and the individual dwelling units. Properties that score well are inspected less often. This score can inform cities’ preservation strategies by providing insight into which properties most need rehabilitation and reinvestment to be preserved.

While REAC inspections are required for most HUD-assisted properties, they are not mandatory for LIHTC properties. Many LIHTC properties are inspected using similar physical inspection standards, but the inspections are not necessarily performed by REAC inspectors. This means that not all LIHTC properties in the NHPD will have REAC scores available, which is a limitation in trying to access property conditions across a jurisdiction’s LIHTC portfolio.

HUD is transitioning from REAC to a new inspection protocol known as the National Standards for the Physical Inspection of Real Estate (NSPIRE). The compliance date for NSPIRE has been extended to October 1, 2025, but some LIHTC properties are already being inspected under NSPIRE. However, NSPIRE scores are not yet recorded in the NHPD, meaning that REAC scores remain the primary inspection metric at the moment.

Example: Creating a preservation inventory for New Haven, Connecticut

To illustrate how the NHPD database can be used in practice, consider an example from New Haven, CT. The NHPD database can be filtered by geography using the browser interface, Excel, or statistical computing software such as R and Python.

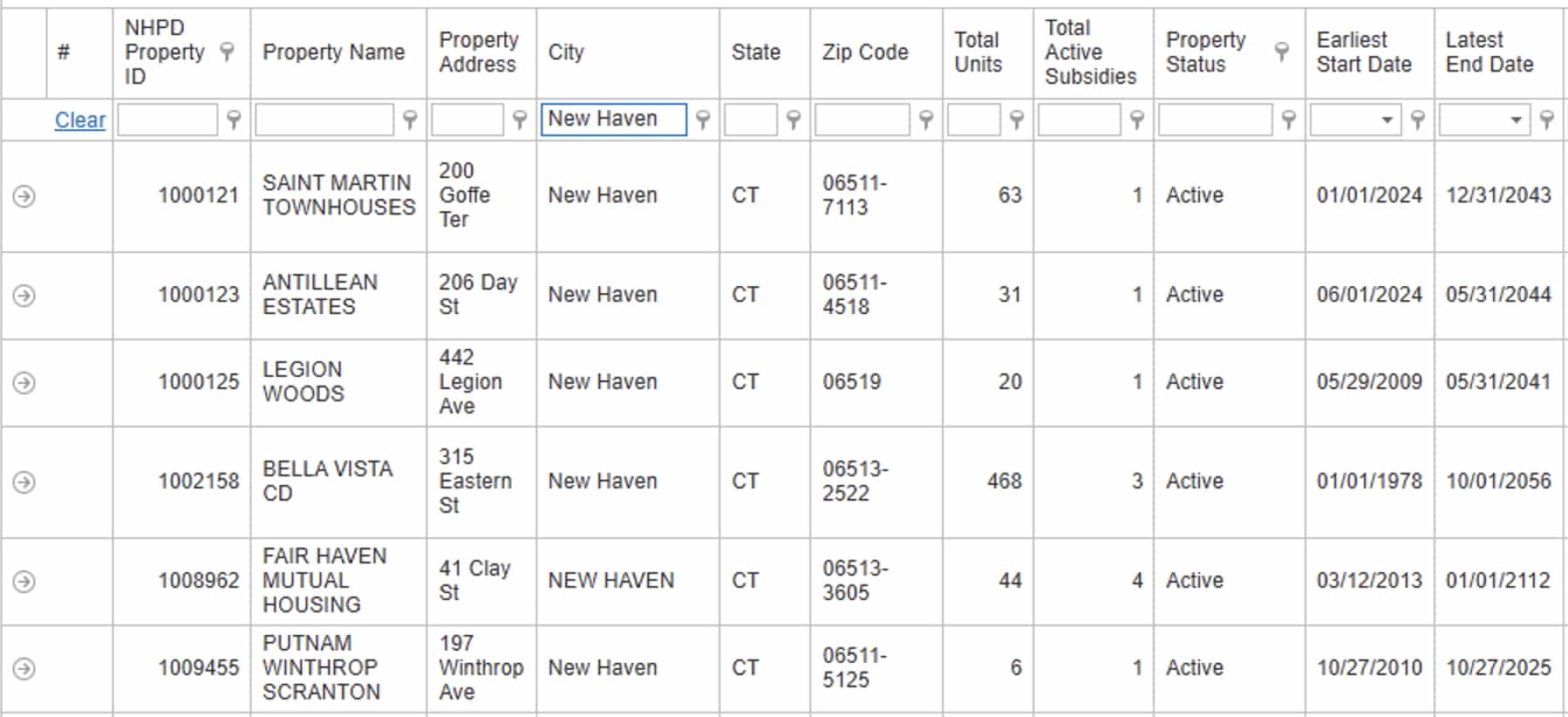

After filtering the data using the NHPD browser interface to include only properties with active subsidies, as shown in Figure 1 below, we find that New Haven, CT, had 109 subsidized, privately owned properties, for a total of 7,238 homes with active subsidies as of April 2025.

Figure 1. List of Active Housing Subsidies in New Haven, CT

Source: National Housing Preservation Database (NHPD) 2025

Ordering the dataset by expiration date

To determine which properties are reaching the end of their current affordability restrictions, we can sort the dataset using the “Earliest End Date” column. Since properties often receive multiple subsidies, they will subsequently have multiple subsidy end dates. The “Earliest End Date” column lists the soonest expiration date for a given property, while the “Latest End Date” column shows the furthest expiration date. While Figure 1 shows the initial sorting done in the browser, all additional analysis will be conducted with downloaded data. In Figure 2 below, we can see that Number One Norton Apartments in New Haven has already seen one of its subsidy contracts expire, but has another subsidy that is not set to expire until 2029.

It is important to note that while sorting the dataset in this way can provide us with valuable information about which properties face imminent expiration, it does not necessarily tell us which are at the greatest risk of becoming unaffordable. There are several factors that can contribute to property owners choosing not to renew the subsidy and opt to raise rents, including property quality, location, local housing market conditions, property size, and ownership type.

For example, a study by Freddie Mac found that LIHTC-subsidized properties run by nonprofit organizations are less likely to leave the program. The same study also found that smaller LIHTC properties are more likely to exit the program, likely because of regulatory burdens that are challenging for small operators. However, these units tend to remain affordable even after leaving the program.

Figure 2. List of Subsidized Properties by Earliest Expiration Date in New Haven, CT

Source: National Housing Preservation Database (NHPD) 2025

Creating data visualizations and conducting additional analysis

Visualizations of NHPD data can help us better understand the characteristics of federally assisted properties facing expiration.

We can subset the NHPD data for New Haven by housing subsidy type, revealing that 31 of New Haven’s properties have active LIHTC subsidies, which account for a total of 2,820 units. In addition, 39 of New Haven’s subsidized properties participate in the Section 8 PBRA program, representing a total of 3,391 units. PBVs are in use in 16 properties, totalling 1,057 units. In Figure 3, we visualize the distribution of assisted units in New Haven across the various subsidy programs, including those assisted by state subsidies. The figure also shows the distribution of units set to expire within the next decade as a fraction of the total number of units within each subsidy program. Specifically, 260 HOME units, 702 LIHTC units, and 511 Section 8 units are set to expire by 2035. This information is available for all of the subsidy programs except for PBVs, as the NHPD database does not currently contain data on HAP contract start and end dates for properties receiving PBVs. Additionally, no units are set to expire in the next decade for properties with state subsidies, so no expiring units are displayed for this category. Note that properties often receive multiple subsidies. Therefore, the total number of units across multiple programs may exceed the total number of units in a given city.

Figure 3. Distribution of Subsidized Units Expiring in the Next Decade (2025-2035) by Type of Subsidy in New Haven, CT

Source: National Housing Preservation Database (NHPD) 2025

Note: Data on subsidy start and end dates for Project-Based Vouchers is not currently available in the NHPD. Additionally, no state subsidies are set to expire in the next decade.

Figure 4 is a bar chart representing the number of affordable housing units in New Haven whose contracts are due to expire over the course of the next decade. The chart shows that 2,394 rental units are at risk of losing their affordability restrictions by 2035, with 142 of those units facing expiration as early as 2025.

This year-by-year data is critical for practitioners planning their preservation pipeline. For example, 657 units, or over a quarter of the city’s at-risk stock, are set to expire in 2028 alone. Without proactive planning, this concentration of expirations could strain local budgets and administrative capacity. To prevent this situation, local stakeholders should consider taking proactive steps. This may include reserving or rolling over preservation funds or pursuing opportunities to refinance units in earlier, lighter-expiration years, such as 2025, 2026, or 2027.

Figure 4. Affordable Units Expiring in the Next Decade (2025-2035) in New Haven, CT

Source: National Housing Preservation Database (NHPD) 2025

Figure 5 shows the distribution of subsidized housing units whose affordability restrictions will expire within the next decade (between 2025 and 2035) across New Haven’s officially recognized neighborhoods. Using this map, we can determine that units facing expiration in the next decade are concentrated in the New Haven neighborhoods of Dixwell and Fair Haven.

Figure 5. Affordable Housing Units Expiring in the Next Decade (2025-2035) by Neighborhood in New Haven, CT

Source: National Housing Preservation Database (NHPD) 2025, U.S. Census Bureau 2023

It may also be useful to analyze expirations in conjunction with REAC scores. These scores, derived from periodic physical inspections conducted every 1 to 3 years, assess various aspects of a property. A passing score is considered a 60. For HUD multifamily programs, property owners with failing REAC scores may be ineligible to renew their contracts until deficiencies are addressed, limiting their ability to retain their subsidies. Conversely, properties with passing scores have a more straightforward path to renewing their subsidies.

In Figure 6, we present a map displaying New Haven’s REAC scores of federally subsidized properties facing expiration within the next decade at the individual property level. Among the 16 subsidized properties set to expire, only one received a failing score at its most recent inspection. This analysis can inform strategies for engaging with property owners to provide incentives to either preserve affordable units or create disincentives for converting them to other uses.

Figure 6. REAC Scores for Subsidized Properties Expiring in the Next Decade (2025-2035) in New Haven, CT

Source: National Housing Preservation Database (NHPD) 2025, U.S. Census Bureau 2023

Note: Color represents REAC Score. Size represents the number of units.

Takeaways and policy recommendations

Tracking when and where federal housing subsidy contracts expire, as well as the physical condition of expiring properties, can help cities and other stakeholders target their preservation efforts and develop programs and policies to protect residents vulnerable to displacement.

Cities can use a variety of tools to preserve affordability. Establishing demolition taxes and condominium conversion fees can discourage property owners from replacing affordable rental units with other uses, but also generate revenue in the event that they do so, contributing to efforts to build or preserve affordable units elsewhere. Offering local tax abatements to developers and investors who preserve affordable housing can also be a compelling incentive to keep rental units affordable.

Practitioners should also be proactively planning for and negotiating with owners of properties with expiring subsidies. If they believe an owner may need to recapitalize, create a new ownership structure, or adjust their approach to keep the property viable as a subsidy expires, they should engage those owners and other stakeholders early to support efforts to preserve affordability.