New York City

- Published:

- July 3, 2024

Locality: New York City, New York (USA)

City Population: 8,336,817 (2019)

Metro Population: 18.8 million (2019)

Plan Title: Housing New York

Date of Plan: 2014 (updated in 2017)

Date of Case Study: October 2020

Substantive highlights

Housing New York is a ten-year strategy, developed in 2014 and updated in 2017, that aims to preserve and increase affordable housing in the five boroughs of New York City. The plan responds to the city’s affordable housing crisis: in 2012 more than half of renters in New York city were rent burdened and between the early 2000s and 2012 rents increased by at least 10 percent while wages stagnated. Housing New York includes five overall strategies to address this crisis:

- Fostering diverse, livable neighborhoods

- Preserving the affordability and quality of the existing housing stock

- Building new affordable housing for all New Yorkers

- Promoting supportive and accessible housing, including for seniors and persons experiencing homelessness

- Refining city financing tools and expanding funding sources for affordable housing

The initial goal of the 2014 plan was to create and preserve 200,000 units of high quality affordable housing. In 2017, because affordable housing efforts were ahead of schedule, the city updated the plan and released Housing New York 2.0 with the new goal of creating and preserving 300,000 affordable housing units over an expanded timeline of twelve years.

The funding behind the Housing New York plan is a mix of public and private resources. The city’s capital funding, which is primarily resourced by the sale of bonds, provides vital financing for affordable housing projects. The city also allocates property tax exemptions that reduce the amount of property taxes owed for affordable housing projects. Additionally, the local Housing Finance Agency contributes agency profits as low cost subsidy financing. A few other local funds, such as specialized funding available to City Council members, and ground lease payments from a past land use transaction (land leasing at Battery Park City) make up the other sources of public funding for the plan. The plan uses federal HOME funds and State of New York grants to build and preserve affordable housing. The plan relies heavily on federally allocated tax-exempt bonds (private activity bonds), and their accompanying as of right tax credits (4% tax credits), as well as the use of taxable bonds offered by the local Housing Finance Agency. Many local banks provide financing to affordable housing projects, leveraging city lending programs and tax exemptions as well.

Housing New York is the latest in a series of comprehensive local housing strategies by New York City. Past strategies include:

- The original Ten-Year Plan in 1986 to rebuild neighborhoods across the city following New York City’s loss of jobs and population in the 1970s

- The New Housing Marketplace plan in 2003 to meet the concurrent challenges of a growing population and housing affordability

Process

In response to the affordable housing crisis in New York City, Mayor Bill de Blasio made affordable housing a top priority of his administration. The creation of the original plan from 2014 was driven by the Deputy Mayor for Housing and Economic Development with input from over 200 individual stakeholders. The development and implementation of the plan required the coordination of some 13 city agencies.

Through neighborhood-based initiatives like the Sustainable Communities East New York, Resilient Edgemere, and Bed-Stuy Housing initiatives, the city worked with residents and several public agencies to establish a community plan to address local needs. These initiatives became a model for initiatives in the overall housing plan that require community engagement. For the Sustainable Communities East New York initiative in Brooklyn for example, the city conducted over 50 outreach events including half-day workshops and visioning sessions open to all area residents and businesses.

In 2017, the city produced Housing New York 2.0. The updated 2017 plan proposed creating and preserving an additional 100,000 affordable housing units by 2026, and announced many initiatives focused on preservation and anti-displacement. The more ambitious target reflected in part the accelerated pace of the original plan.

Metrics, targets, and implementation

The Housing New York 2.0 plan of 2017 identifies two overall numerical goals to achieve by 2026:

- Construct 120,000 affordable housing units (originally 80,000 units in the 2014 plan)

- Preserve 180,000 affordable housing units (originally 120,000 units in the 2014 plan)

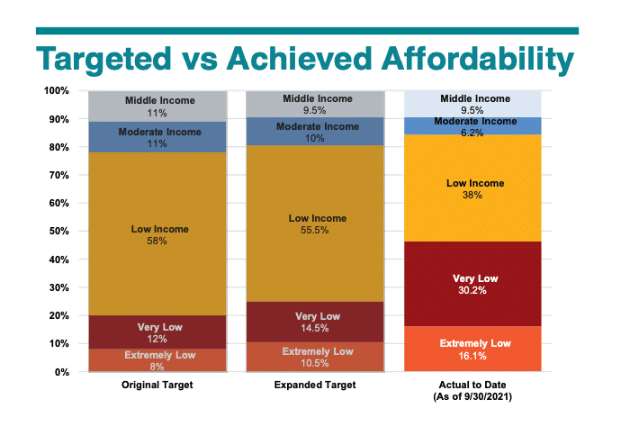

The plan aims to construct and preserve a combined 300,000 units for five income groups in the following proportions:

- 31,500 units (10.5%) for households with extremely low incomes (0-30% AMI)

- 43,500 units (14.5%) for households with very low incomes (31-50% AMI)

- 166,500 units (55.5%) for households with low incomes (51-80% AMI)

- 30,000 units (10%) for households with moderate incomes (81-120% AMI)

- 28,000 units (9.5%) for households with middle incomes (121-165% AMI)

Implementation status

In the period from 2014 to 2020, 114,386 affordable housing units were preserved and 49,818 constructed. The share of affordable housing preserved and constructed in this time period by income group is as follows:

- 25,394 units (15.5%) for households with extremely low incomes (0-30% AMI)

- 46,775 units (28.5%) for households with very low incomes (31-50% AMI)

- 65,938 units (40%) for households with low incomes (51-80% AMI)

- 10,398 units (6%) for households with moderate incomes (81-120% AMI)

- 14,891 units (9%) for households with middle incomes (121-165% AMI)

The city also expanded eligibility for the Senior Citizen Rent Increase Exemption (SCRIE) and the Disability Rent Increase Exemption (DRIE) to freeze rents for more people living in rent-regulated apartments. In 2015, the City Council created the Tenant Harassment Prevention Task Force to investigate harassment claims and enforce anti-discrimination laws and in 2017, they introduced universal access to legal representation in Housing Court for all households facing eviction.

New York City Mayor Bill de Blasio’s term ended in December of 2021, concluding his administration’s Housing New York plan. The Mayor’s Office released a final report on the plan’s progress. According to this report, the city was able to build or preserve 200,000 affordable homes by the end of 2021. Of these homes, 15.7% are affordable to households with middle and moderate incomes, defined as between 80% and 165% of the Area Median Income (AMI), while 68.2% are affordable to households with low or very low incomes –between 80% and 30% AMI– and 16.1% are affordable to households earning less than 30% AMI, classified as extremely low-income.

Coverage of four policy pillars

| Coverage of Four Policy Pillars | Not Covered | Moderate Focus | Substantial Focus |

| Create and preserve dedicated affordable housing units | – | – | ✓ |

| Promote affordability by reducing barriers to new supply | – | – | ✓ |

| Help households access private-market homes | – | ✓ | – |

| Protect against displacement and poor housing conditions | – | – | ✓ |

Participating agencies

| Participating Agencies | No Role | Supporting Role | Leading Role |

| Office of the Mayor | – | – | ✓ |

| Office of the City/County Manager | ✓ | – | |

| Housing Department | – | – | ✓ |

| Planning Department | – | – | ✓ |

| Development Agency | – | ✓ | – |

| Permitting/Inspections Department | – | ✓ | – |

| Finance/Tax Department | – | ✓ | – |

| Public Housing Authority | – | ✓ | – |

| City/County Council | – | ✓ | – |

Policy tools

Housing New York and Housing New York 2.0 include the several policy tools, organized according to the categories listed below.

Fostering diverse, livable neighborhoods

- Identify opportunities for affordable housing in all five boroughs and investments to meet the neighborhood’s infrastructure and service needs.

- Implement a Mandatory Inclusionary Housing Program. The city will require a portion of the new housing developed to be permanently affordable to low- or moderate-income households.

- Harness affordable housing investments to generate quality jobs. The construction and preservation of 200,000 units of housing is projected to create 194,000 temporary construction jobs and nearly 7,100 permanent jobs.

- Help New Yorkers buy a piece of their neighborhoods through programs to construct new condos and co-ops for first-time homebuyers and help existing homeowners make needed repairs.

Preserving the affordability and quality of the existing housing stock

- Protect tenants and stem the tide of rent deregulation. The city will work with the State as rent regulation comes up for renewal in 2015 to prevent abuses of the vacancy and luxury decontrol provisions and capital improvement rules.

- Adopt a more strategic approach to preservation. The city will identify neighborhoods and portfolios that are at risk of becoming unaffordable and proactively work with owners, lenders, and investors to ensure that city resources are appropriately targeted.

- Introduce simple and flexible incentives to preserve long-term affordability. The city will work with the State to develop easy-to-use tax incentives for buildings that do not have extensive capital needs but are at risk of leaving rent regulations or being converted to condominiums.

- Preserve the affordability of unregulated housing where rents may rise because of changing neighborhood conditions. The city will develop new incentive programs to encourage landlords in transitioning areas to restrict incomes and rents.

- Pilot a new program to incentivize energy efficiency retrofits for affordable housing in need of preservation , including small and midsize buildings, creating energy savings and long-term affordability.

- Build a firewall against displacement by helping non-profits purchase traditional rent-stabilized apartment buildings and keep them affordable to current residents.

- Protect affordability at Mitchell-Lama buildings, which represent some of the last already existing affordable homeownership opportunities.

Building new affordable housing for all New Yorkers

- Significantly increase the number of units serving the lowest-income New Yorkers. The city will serve more than four times as many of the lowest-income New Yorkers (those earning below 30% of AMI) over the 10 years of this plan as were served over the previous 12 years.

- Develop affordable housing on underused public and private sites. The city will perform a comprehensive survey of all vacant sites in the city.

- Create two new programs to develop small, vacant sites. The city will launch the Neighborhood Construction Program (NCP) and the New Infill Homeownership Opportunities Program (NIHOP). These programs will aggregate sites to develop affordable housing, including one- to four-family homeownership opportunities and up to 20-unit rental buildings.

- Introduce new mixed-income programs. The city will pilot a new mixed income program that targets 20 percent of a project’s units to low-income households, 30 percent for moderate income households, and 50 percent for middle-income households.

- Engage New York City Housing Authority residents and the surrounding communities to identify local needs and opportunities. This collaborative process will focus on the preservation of NYCHA units and assess the potential of underused NYCHA land and development rights.

- Reform zoning, building and housing codes, and other regulations to lower costs and unlock development opportunities. The city will re-examine parking requirements, zoning envelope constraints, restrictions on the transferability of development rights, and regulations on affordable housing programs.

- Stretch the city’s housing subsidy dollars further. The city will revise the terms of the existing subsidy programs and better align tax exemptions to ensure incentives are no greater than necessary to incentivize production of units for New York’s neediest families.

- Ensure sustainable affordable housing tailored to the city’s demographics. The city will commit to being a leader in developing new technologies and building standards.

- Capitalize on advances in technology and innovative design to expand modular building and micro-units.

- Unlock the potential of vacant lots long considered too small or irregular for traditional housing stock with innovative smaller homes.

Promoting supportive and accessible housing, including for seniors and persons experiencing homelessness

- Shift funding from high-cost homeless shelters to lower-cost permanent housing.

- Develop more supportive housing to improve health outcomes and save public dollars. The city will seek to renew its partnership with the State to expand the supply of supportive housing and to broaden the target populations it serves.

- Create more homes for seniors by dedicating underused public lots for new affordable senior housing.

Refining City Financing Tools and Expanding Funding Sources for Affordable Housing

- Target and Strengthen City Tax Incentives

- The task force will consider pursuing legislative authority to expand the 421-a Geographic Exclusion Areas to match the areas designated for Inclusionary Housing. In strong markets, the city will require more affordable units and/or deeper affordability to receive this benefit.

- Streamline program administration by eliminating the Preliminary Certificate of Eligibility and making construction period benefits retroactive for 421-a tax exemptions.

- Harness homeownership development to produce affordable rental housing by (a) requiring developers to construct off-site affordable rental units within a prescribed geographic radius of the market rate homeownership units, or (b) requiring payments into a fund to be used for that purpose.

- Modify the J-51 tax incentive to encourage improvements to building systems and major capital improvement (MCI) such as plumbing, heating, and windows.

- Streamline the administration of 420-c tax incentive properties where rents in 70 percent of units are affordable to households up to 60%of AMI.

- Expand New York City Industrial Development Agency Authority to assist with the development or renovation of residential and mixed-use projects.

- Identify New Funding Streams to Fund Affordable Housing

- Given that the availability of subsidy is limited and subject to cuts to the Federal budget and the continuing need for the city to fund other important projects and programs, the task force will explore a number of potential sources that could be dedicated to fund affordable housing.

- Increase Private Leverage and Expand Existing Financing Tools

- Increase the pension fund’s commitment to affordable housing.

- “Bifurcated” mixed-income financing to finance only the low-income units in a mixed-income development, rather than financing the entire project.

- Tax-exempt bond recycling which can use prepayment from bond-financed loans for eligible tax-exempt affordable housing projects.

- Enter into a further agreement on land leasing to Battery Park City Authority after the current agreement expires to provide additional resources for affordable housing.

- Public/Private and Philanthropic Partnerships

- Expand use of New Markets Tax Credits which incentivize investments in designated Community Development Entities.

- Explore partnerships through the U.S. Department of Treasury Community Development Financial Institutions Fund.

- Leverage Social Impact Bonds to finance supportive housing.

- Partner with philanthropic organizations and financial institutions.

- Create a development finance toolbox to provide the development community with a customized resource to harness programs that maximize potential funding sources.

- Re-Evaluate HPD and HDC Programs to Stretch City Housing Subsidy Dollars Further

Income groups targeted

| Income groups targeted | Little/No Focus | Moderate Focus | Substantial Focus |

| 0-30% AMI | – | – | ✓ |

| 30-60% AMI | – | – | ✓ |

| 60-80% AMI | – | – | ✓ |

| 80-120% AMI | – | ✓ | – |

| Market Rate | – | ✓ | – |

Key policy objectives or issues addressed

Which Linkages Are Addressed

| Environment/ Energy/Sustainability | Transportation |

| Employment/Workforce Development |

Which Local Funding Sources Are Proposed?

| New York City Pension Funds | Recycled tax-exempt bonds |

| Excess reserves of the local housing finance authority (HDC) | Land lease rents paid to Battery Park City Authority (BPCA) |

| Philanthropic partnerships | Property tax exemptions |

| Private equity, bank investments and loans, and public capital markets |